New Jersey’s estate tax is paid by heirs who inherit more than $675,000. That is the nation’s lowest threshold. The federal estate tax exemption for 2016 is $5.45 million…Proponents say it makes New Jersey less competitive and drives out wealth.

Samantha Marcus, NJ.com

A bi-partisan plan for rescuing NJ’s Transportation Trust Fund from bankruptcy is being discussed by state senators Paul Sarlo (D-36), Steven Oroho (R-24), and others. The plan will provide $2 billion per year to maintain the state’s roads, bridges, tunnels, and rails while at the same time helping NJ’s middle class. The framework includes phasing out the estate tax. If the value of your home and assets is greater than $657,000 when you die (not uncommon in NJ), this will help your family and help fix the state’s infrastructure.

Click here to read more about the bi-partisan proposal.

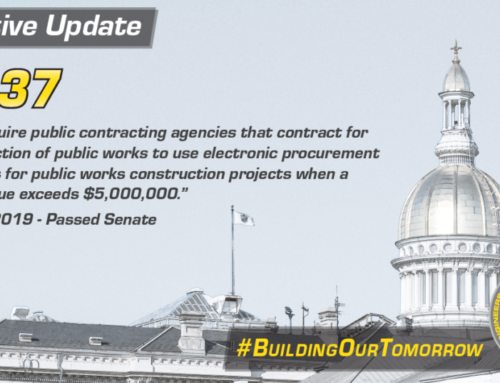

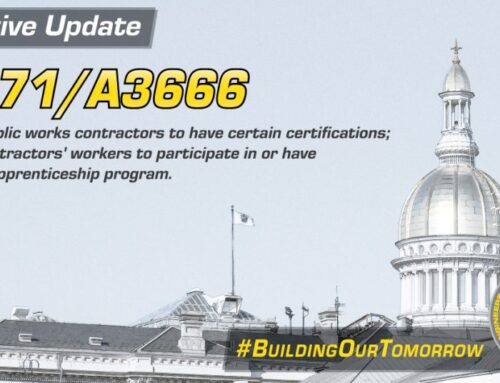

ELEC825 supports a fully funded Transportation Trust Fund that is DEDICATED to capital improvements.